Devanjana Mukherjee, Khabri Media

The application of GST (Goods and Services Tax) to water from natural sources, can vary by country and region and is typically exempted from any taxation.

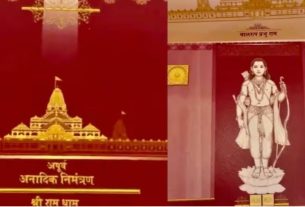

Pic: Social Media

The Central Board of Indirect Taxes and Customs has issued a clarification in response to reports that 18 percent GST is placed on Gangajal, claiming that no GST is applied on Gangajal and other puja goods. The revenue division of the Finance Ministry made it clear on October 12 that gangajal and other commodities used in religious worship are free under the Goods and Services Tax (GST) before the festival season.

The CBIC on Thursday said that there is no GST on Gangajal, amid Congress claims that the government has imposed an 18 percent tax on it. GST on ‘puja samagri’ was discussed in detail in the 14th and 15th meetings of the GST Council held on May 18-19, 2017, and June 3, 2017, respectively and it was decided to keep them on the exempt list.

Pic: Social Media

Other puja goods like kajal, kumkum, bindis, sindoo, alta, plastic, etc. are exempt from GST, according to the information provided. In September, the government collected more GST than it did in August, up 2.3 percent, or 10.2 percent year over year, to $1.63 lakh crore.

MUST READ: Severe water shortage in NCR

Abbreviation to Goods and Service Tax, this value-added tax is levied on the supply of goods and services in many countries around the world. In India, the GST system has multiple tax slabs, one of which is an 18% GST rate. This rate is applied to a variety of goods and services in the country.

Here are some common items and services that fall under the 18% GST rate:

Goods:

Most household appliances and electronics, such as refrigerators, washing machines, and televisions.

Processed food items that do not fall under the lower GST rate category.

Furniture and fittings.

Certain construction materials.

Some personal care and beauty products.

Services:

Standard or regular services, including professional services like legal and accounting services.

Non-luxury dining at restaurants.

Telecommunication services.

Some financial services and insurance products.

Accommodation in mid-range hotels.

However, it’s essential to note that processed or packaged water, such as bottled water, may be subject to GST. The applicable tax rate on bottled water can vary depending on its specific tax regulations. In some countries, bottled water may be subject to a lower GST rate, while in others, it may be subject to a standard rate.