Devanjana Mukherjee, Khabri Media

In an increasingly digitalized world, where our smartphones have become the key to our personal and financial information, the SIM swap scam has emerged as a concerning threat to digital security in India.

Pic: Social Media

The latest to be a victim of the phone hacking fraud is an advocate in North Delhi who lost money from her bank account after having three missed calls from unknown numbers. The cyber unit of the Delhi police claims that the victim did not answer the phone or share an OTP. However, the accused was able to get her banking details and private data.

The incident took place after in February, a private school teacher lost Rs 1.5 lakh through eight transactions in less than three hours after scamsters got hold of his two bank accounts. The teacher alleged he had not received any calls, texts or shared bank OTPs with anyone. He too received missed calls and later lost most of his savings.

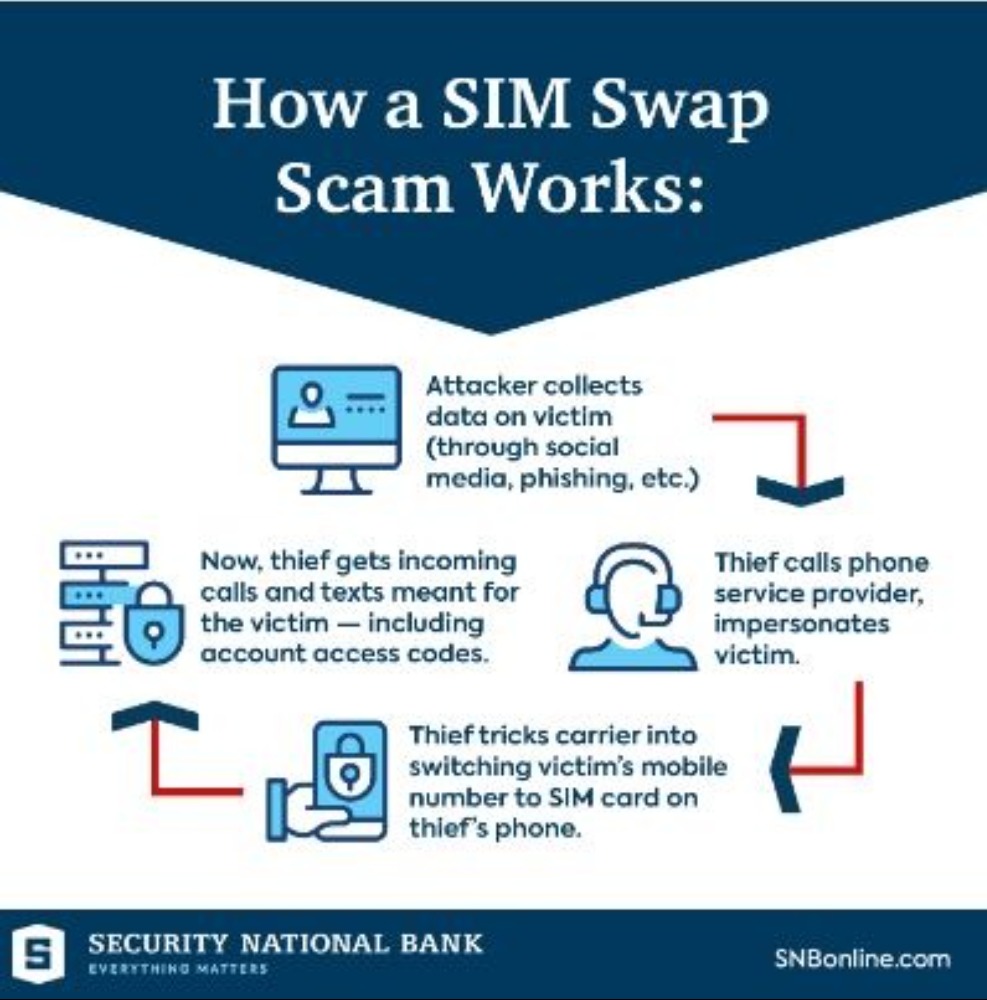

Pic: Social Media

A SIM swap scam, also known as SIM card fraud, is a method used by cybercriminals to take over an individual’s mobile phone number. This is achieved by convincing a telecom provider to deactivate the victim’s legitimate SIM card and activate a new one under the control of the scammer.

The scam often begins with the fraudster obtaining sensitive personal information about the victim, such as their name, phone number, and address. Armed with this data, the scammer contacts the victim’s mobile service provider, posing as the legitimate owner of the account.

ALSO READ: Cryptocurrency fraud in India

Once the service provider is convinced of the scammer’s authenticity, they will deactivate the legitimate SIM card and activate a new one under the scammer’s control. With the victim’s phone number now in their possession, the fraudster can intercept SMS messages and two-factor authentication codes, gaining unauthorized access to the victim’s accounts, which may include bank accounts, email, and various other online services.

One particularly concerning aspect is the ease with which scammers can access bank accounts and conduct fraudulent transactions. With the victim’s phone number in their control, the fraudster can manipulate the victim’s online banking accounts, often leading to substantial financial losses before the victim even realizes that they have been targeted.

Pic: Social Media

To protect oneself from SIM swap scam, we should consider following few precautionary measures,

- Enabling strong and unique password for online banking.

- Frequently check your bank and online accounts for any unusual or unauthorized transactions.

- If you receive unsolicited calls or messages asking for personal information or account details, be cautious and verify the identity of the caller.

- Be cautious about sharing personal information, such as your name, phone number, and address, especially in online forums and social media.

- Contact your mobile service provider to enable SIM card locking, which requires a PIN to be entered when activating a new SIM card.

- Stay vigilant about the latest cybersecurity threats and best practices for protecting your digital presence.

To address the growing threat of SIM swap scams, the telecommunications industry has been working to enhance security measures and raise awareness among customers. Several steps have been taken to combat various forms of cybercrimes such as SMS Alert, Stricter Verification, Biometric Authentication, Customer Education, and so on.

SIM swap scams have become increasingly prevalent in India in recent years. The rapid expansion of mobile-based banking and online payment systems in India has made SIM swap scams particularly lucrative for cybercriminals. The financial incentive for scammers to carry out these attacks is significant, and the relative lack of awareness among the general population about the threat makes it an appealing option.